How to benchmark your portfolio?

In this guide, we will cover why benchmarking your performance is important, how to choose the right benchmarks for you and learn more how to do it on Portseido.

Why benchmarking your performance?

One reason to consider benchmarking is opportunity cost. Opportunity cost is a benefit you forego when choosing one alternative over another. In the case of investing, when considering investing in an asset, investors always have other alternatives to invest the same capital in. As such, we can say that foregone benefit is the true cost of investing. However, comparing every decision made in investing with the next best alternative at the given time can be time consuming. Hence, most people will find that professional investors have been using various indices as a next best alternative instead.

A stock portfolio with a return of 10% might seem good. However, when compared to a benchmark which returns 20%, the portfolio’s true performance might not look so good now. Investors will be able to grade their own skill and find the performance gaps for improvement over time. By comparing to benchmarks, investors can gain more insights in their investments. We will discuss more on that later.

How to choose your benchmarks?

Since the goal in benchmarking the portfolio is to consider opportunity cost and to learn the most out of it, the benchmark itself should be comparable to the portfolio. What that means is, a benchmark should have a similar risk and return profile as the portfolio because this allows the investor to reflect on how much value has been added by their involvement in actively managing the capital instead of investing the same capital into similar assets. Comparing a portfolio to a benchmark with different risk levels is inappropriate because the difference in returns might be from a more conservative / aggressive risk level.

One of the common ways to match the risk and return profile is to match the asset classes. The asset classes can be as narrow as the same asset class in a specific industry of a country. The followings are some popular indices / ETFs for stock portfolios:

- S&P500–500 leading publicly-traded companies in U.S. weighted by market capitalization

- Nasdaq — 3,000+ common equities listed in Nasdaq stock exchange weighted by market capitalization (Although it contains many companies in various industries, it is commonly used as an index representing tech companies since it has a high concentration of them)

- NYSE — 2,400+ common stocks listed in New York Stock Exchange (NYSE) weighted by free-float adjusted market capitalization (stock price times the number of shares readily available in the market)

- Dow Jones Industrial Average (DJIA) — 30 large well-established and financially-sound companies based on certain criteria listed in NYSE and Nasdaq weighted by price

- MSCI World Index — 1,500+ large and mid cap companies across 23 developed countries weighted by free-float adjusted market capitalization

- QQQ — ETF that tracks 100 largest non-financial companies listed in Nasdaq (regarded as large cap growth fund)

- EEM — ETF that tracks MSCI Emerging Market (large and mid cap companies across 25 emerging markets weighted by free-float adjusted market capitalization)

In addition to the list above, Portseido also offers other ETFs and indices. Check it out on Portseido.

How Portseido benchmark your performance?

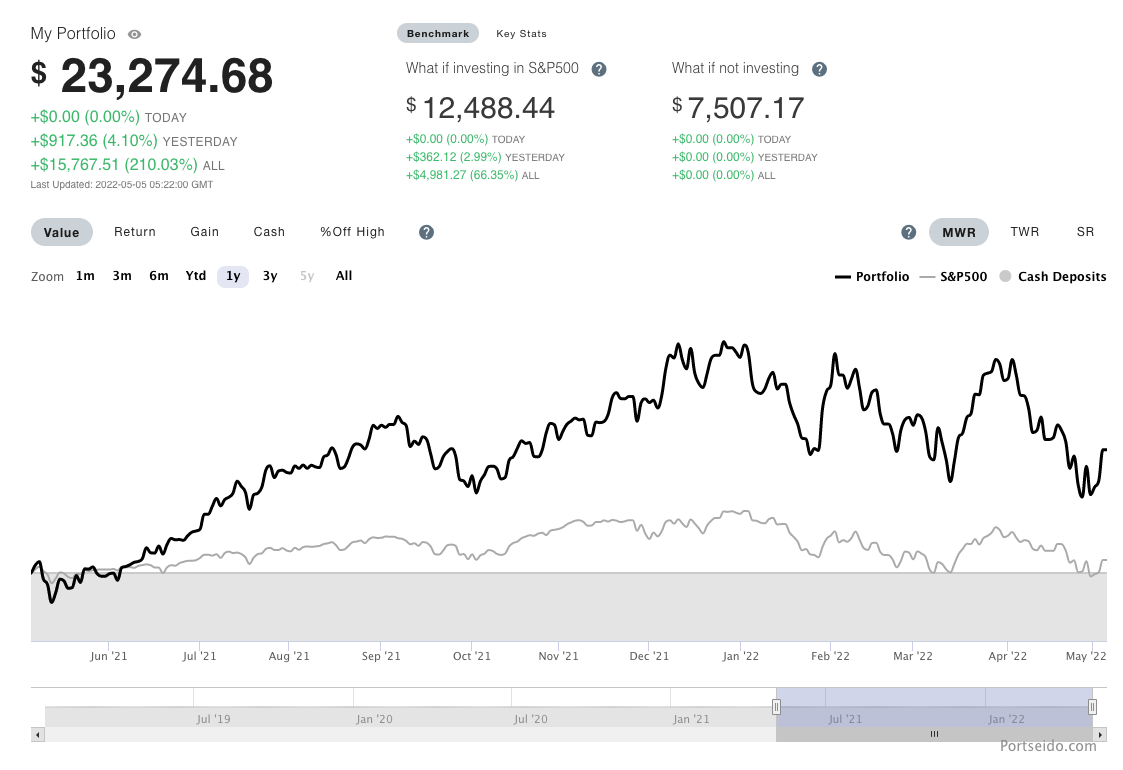

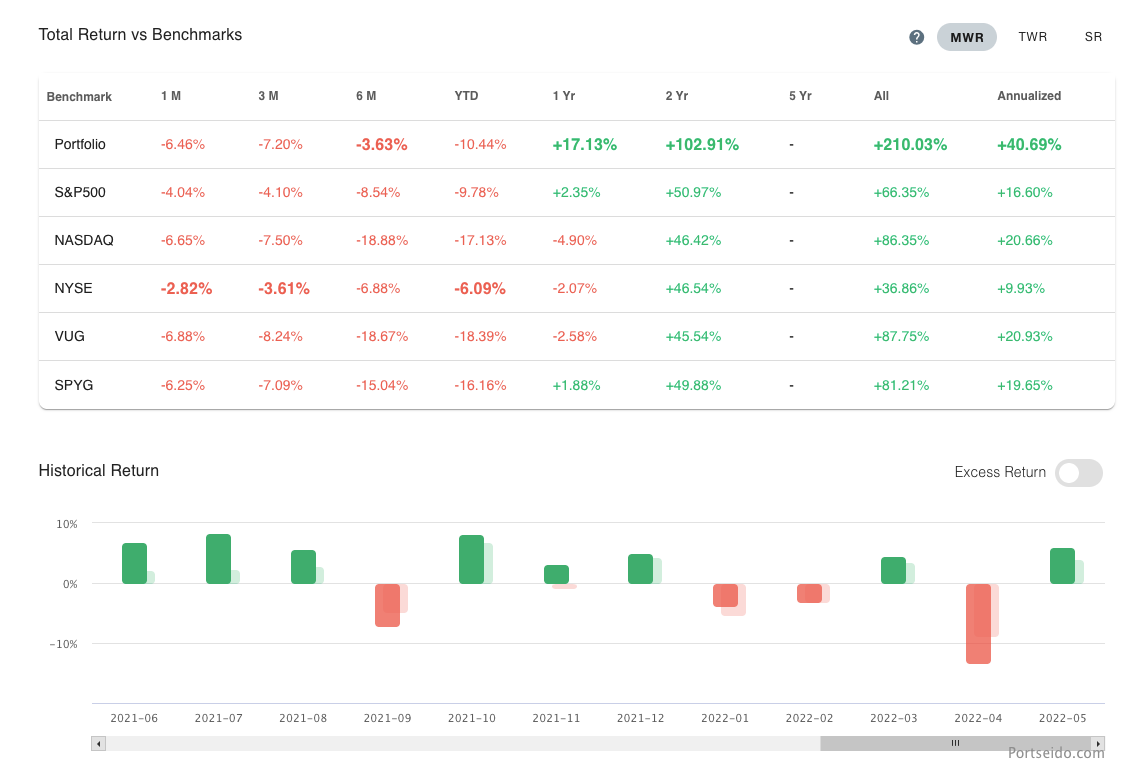

Instead of using simple return on the benchmarks to compare to your performance, Portseido uses Money Weighted Return as default since it factors in both time and amount into the calculations. (We have that covered in another guide here) Furthermore, instead of comparing yours to benchmark price performance, Portseido takes it to another level by using hypothetical portfolio (What if you invested in benchmark immediately instead when you deposited cash in). Therefore, the benchmark return on Portseido might not be equal to what others stated.