Which return metrics you should use? SR, TWR or MWR

At Portseido, one of the most frequently asked questions is which metric should the investor use to track portfolio performance. Thus, in this article, we will discuss about the three methods for calculating return; Simple Return (SR), Time-Weighted Return (TWR) and Money-Weighted Return (MWR).

Why does it matter?

Let’s start with an example. Imagine your portfolio has gained $500 in the past year over an $1,000 initial investment. It’s a 50% gain over a one-year period (what a great return!). Then you get a bonus from your work and decide to put in another $2,000 (your port is now $3,500). A week goes by and your port is up another 1% (from $3,500 to $3,535), not bad for a one-week return. The question is what is your total return now?

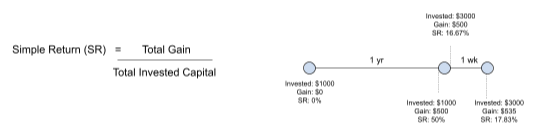

Simple Return (SR)

One simple way (hence called Simple Return) is to simply take the total gain divided by your total investment. Using this method, your return will be 50% at the 1-year mark, then drop to 16.67% after you put in $2,000, then up to 17.78% after a week. This does not seem fair. You performed remarkably well last year and got off with even better performance (1% for 1-week which annualizes to 67%!) but somehow the return does not seem to reflect that. It is because the SR method doesn’t care about “how long” the capital has been in your port (the last $2,000 has only been in the portfolio for a week, what do you expect the gain gonna be?!). So when there is cash inflow and outflow of the portfolio, SR is not a good method to measure your investment ability but a mere tool for book-keeping.

Time-Weighted Return (TWR)

So instead of ignoring the “time”, let’s instead ignore the “size” and compute the return separately in each subperiods. We then combine them to get the compound return over the total period. This method is called Time-Weighted Return (TWR). For example, the portfolio above gives the TWR of 51.5% (or you can annualize it to get 50.32%). TWR is better at measuring your ability as it tries to average your “ability” over time regardless of the portfolio size.

This method also has its drawback mainly because, well, it ignores the “size” and gives an equal weight to each sub-periods. Imagine the portfolio above, suppose in the second year, your portfolio ends up being down 20% (from $3,500 to $2,800). You actually incur a loss of $200 for a two-year period, but your TWR over the same period is actually +20% !?!?

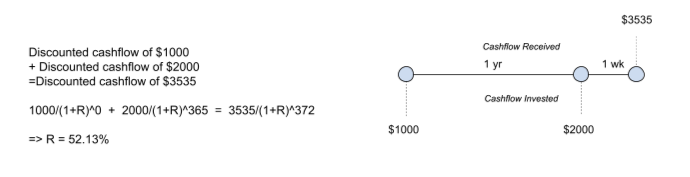

Money-Weighted Return (MWR)

So how can we combine both “time” and “size” then? We need to resort to the concept of discounted cash flow. Essentially, we want to find the rate of return that makes the sum of discounted cash inflow (all invested amount) equal to the sum of discounted cash outflow (current portfolio value). This method is called Money-Weighted Return (MWR). This method requires some math to solve for such a return when there are multiple cash flows deposited into the portfolio.

For example, in the portfolio above, we will get the MWR return of 52.13%. Note that it is slightly higher than TWR because it gives more weight to the last 1-week return (67% annualized) due to more capital invested during that period.

While this method seems best as it captures both “time” and “size”, its limitation arises when your cash movement decisions are not based on investment reasons. Since MWR gives more weight to the performance when the portfolio size is largest, while you might not invest more during a period because you think there are opportunities but more from a personal reason, MWR can distort the return from those cash movements. For example, a part-time investor who receives annual bonuses from his or her full time job might decide to invest most of that amount immediately. However, while such a decision is not based on investment reasons, the investments have gone up, and, since MWR gives more weight to such a period, MWR will be significantly higher due to higher weight while it does not truly reflect investor’s investment skill.

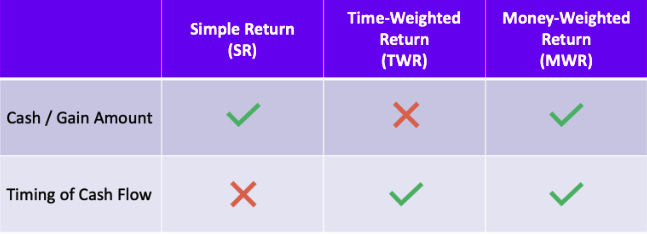

So which method should I use?

Like all great questions, the answer is “it depends”. If you are able to make cash flow decisions based on investment reasons (e.g. be able to raise more cash when opportunity arises), Money-Weighted Return (MWR) will be a good fit. On the other hand, if you have no control over cash flow, Time-Weighted Return will be more appropriate. Moreover, both MWR and TWR are the answers for their own questions. If you are asking how your investments were doing over a period of time, MWR will be the one to look at. While, on the other hand, if you try to assess how well you allocated the portfolios over the period, TWR will be more appropriate.

Lastly, note that if you do not deposit any cash except at the beginning, the three methods will give the same number, so no worries there!