What is multiple cash currencies settings?

In some investment accounts, cash can exist in multiple currencies while some are not. In this guide, we attempt to explain how Portseido deals with cash so you can decide which one best suits you.

Single Cash Currency

With the default mode, Portseido assumes that your portfolio only contains one currency which is the portfolio main currency. When there is a cash outflow transaction (such as Buy, Withdraw and Fees) in another currency, this pile of cash will be converted to the specified currency right on the day of the transaction (just enough to be used in the transaction).

This impacts the portfolio in two main ways:

1. Foreign Exchange Rate Gain / Loss

Since cash is converted just in time for each transaction, there will be no exchange rate gain or loss for cash on hand.

2. Cash Deposits

Cash exists only in one currency and that same pile of cash is automatically converted back and forth as needed.

For example, you have deposited USD 10,000 to the portfolio, then on April 20th of 2020, you buy a stock for EUR 5,000. Portseido converts just enough of your cash (in USD) to cover 5,000 EUR needed to make a purchase on that day (1.0794 EUR/USD - 5,000 EUR => 4,632.2 USD) leaving you with 5,367.8 USD.

This can make a major difference in the calculation compared to the Multiple Cash Currencies option.

Multiple Cash Currencies

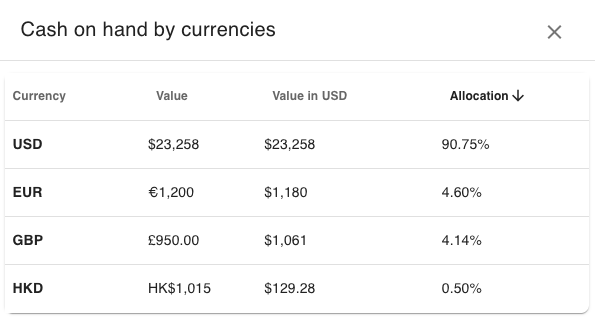

With multiple cash currencies enabled, you will be able to have multiple currencies for cash on hand, and no automatic currency conversion occurs. Which means, in order to buy an asset in one currency, you will have to either deposit cash in that currency or convert the cash yourself first. Here are impacts to the calculation:

1. Foreign Exchange Rate Gain / Loss

Since cash exists in other currencies, the exchange rate gain / loss will be incorporated for the cash on hand.

2. Cash Deposits

There will be multiple cash accounts and each will be treated separately.

For example, you have deposited USD 10,000 to the portfolio. Then if you buy a stock for EUR 5,000, the system will assume that you don't have enough EUR to fund such a transaction, and the system will add EUR 5,000 automatically to your portfolio. Your portfolio will end up with USD 10,000 of cash and EUR 5,000 worth of stock instead of only EUR 5,000 and USD cash left over after the transaction in the previous option.

Which option should you use?

For those who always convert cash just enough to fund each transaction and want to save some time inputting such conversion yourself, disabling multiple cash currencies is best suited for you. This option is chosen by default, so you’re good here.

However, those who have multiple currencies in their portfolio may choose to enable the multiple currencies option. In this way, you can preserve a higher accuracy and see more info on how much cash you hold in each currency.

How to change this settings on Portseido?

To change this settings, you can visit our settings page and click Calculation Methods.