Track Margin and Short Selling

Most portfolios from the brokers are usually cash account. This means you deposit the cash in and use that cash in buying and selling assets.

On the other hand, you can borrow the cash from your brokers and buy the assets using only a portion of your own money in the transactions. Or borrowing a stock from your brokers and sell it to anticipate in a downturn of the asset. These are called margin and short selling respectively.

Default Option (Disabled)

By default, when you create a portfolio in Portseido, the margin and short selling option is disabled. So what happens if this option is disabled?

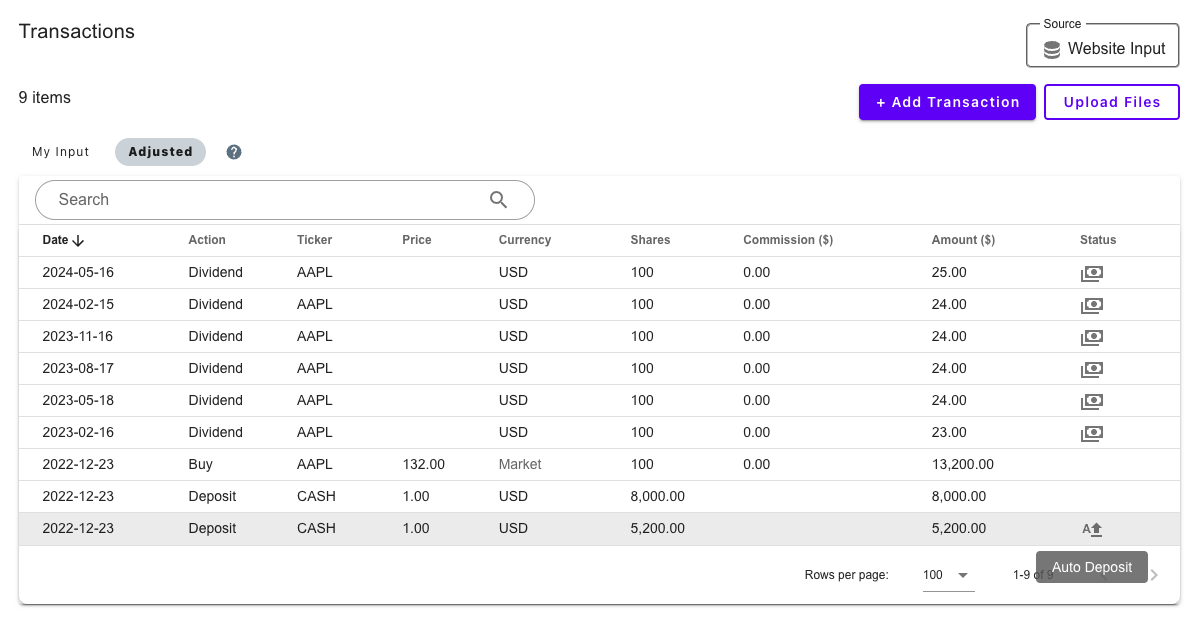

1. Automatic Deposits

When you entered a transaction with a cash outflow (i.e. Buy, Fees, Interest expense, etc.) with not enough cash left on the transaction date, the system will add a deposit transaction automatically for you with the amount just enough to fund such a transaction. You can take a look at those automatic transactions in Transaction page under Adjusted tab.

2. Short selling restriction

On the other hand, when you added a Sell transaction with such assets in your portfolio, the transactions will be excluded in the calculation. Although the transaction is recorded, it is not used in final calculation.

Enable Margin and Short Selling

By enabling this, those mechanics explained above will not be used in the calculation process. This means:

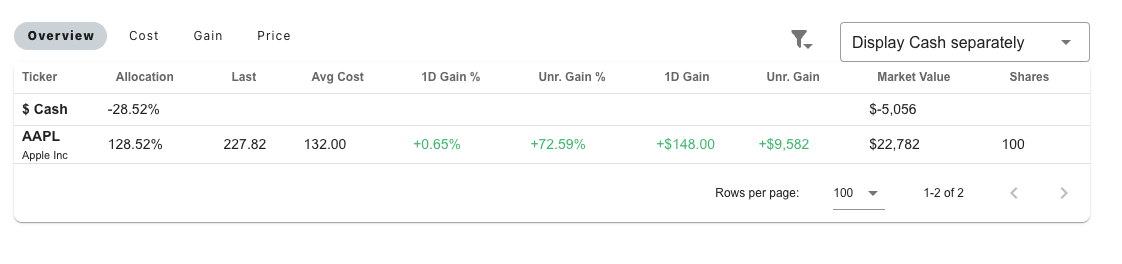

1. No Automatic Deposits

There will be no automatic deposit. You are required to enter all the deposits yourself unless the return calculation might not be available given there is no initial investment at all. On the other hand, your cash amount now can be negative indicating a usage of margin.

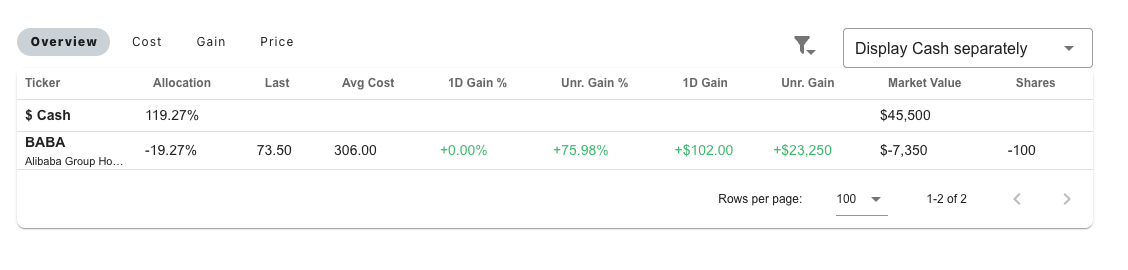

2. Short Selling

All the sell transactions with no stocks prior to the transactions will be included in the calculation. This will result in the negative number of shares and additional cash settled from the transactions.

How to change the settings?

To enable the margin and short selling usage, you can go to Settings page. Click the ... button on the portfolio you want to enable and click Edit Settings. In the dialog, you can enable the option and click Save.

FAQ

Q1: The number looks incorrect after I enable margin and short selling. What should I do?

A: The most important change for the feature is there is no automatic deposit calculated for you. You have to enter all the deposits yourself before made a transaction. Therefore, it is suggested to check your cash deposit transactions.

On the other hand, if this feature is disable, normally the system will add auto-deposit transactions.

Q2: I enable margin / short selling and don't like it. Can I switch it back?

A: Yes, you can revert your decision back anytime. Just go to Setting menu and toggle off the option to disable margin / short selling.

Q3: How can I determine what asset is in net short position?

A: You can check in Dashboard's home page. In my holding section, there is a column called "Shares". If the figure is negative, that indicates net short position.